Market Update: Q1 2024

Optimistic Start to 2024

Happy New Year! An unexpectedly strong finish to 2023 has provided a solid foundation for 2024, as inflation continued to drop without a recession and larger additional interest rate cuts are expected for 2024. After aggressively hiking interest rates to 5.25-5.5%, the Federal Reserve announced in Q4 that it plans to cut rates by as much as 0.75% in 2024. The expectation of further easing led to a broad rally in stocks, with most equity indices posting double digit returns and bond yields falling dramatically during the quarter.

While the S&P 500 ended the year up 26%, this can be misleading, as this capitalization based index was driven largely by seven stocks. The “Magnificent 7”, Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia, and Tesla, were up more than 100% on average. For comparison, without the Mag7, the remaining 493 stocks delivered a still strong, and far more realistic, 12%.

The strength in the stock market last year was a surprise to many, including us, especially since the overall market will likely see no growth in earnings in 2023. Here again, we expect a dichotomy between the Mag7 stocks, which are estimated to grow earnings by 40%, versus the remaining 493 stocks, where earnings are expected to have declined by 3%. Looking ahead, 2024 should see earnings growth more in line with long-term averages, but valuations remain historically high at 20x 2024 earnings, so many stocks will have to beat expectations to keep their stock price up.

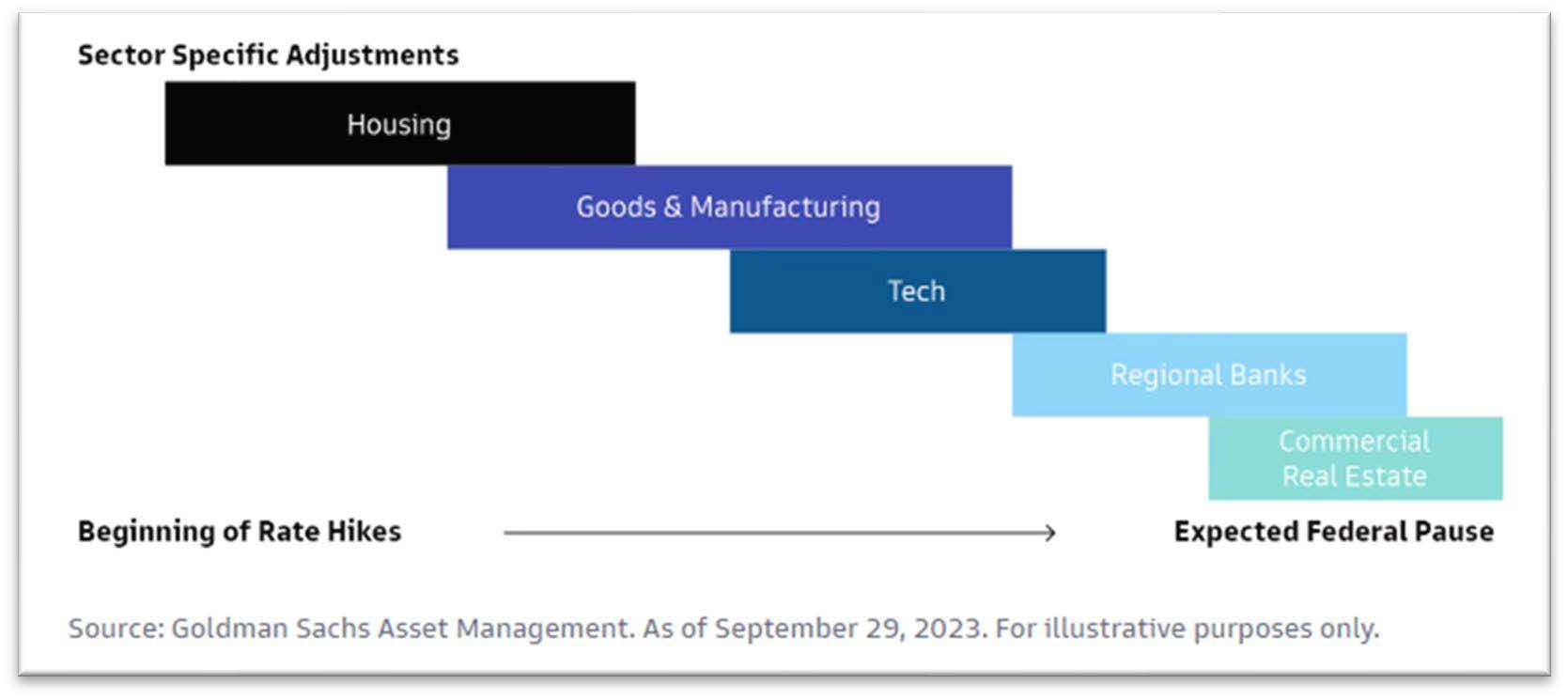

For the past two years, many have been anticipating a recession due to the compounding pressures of higher interest rates and inflation. However, as the US economy has evolved to a more service and financial economy, the impact of higher interest rates should be smaller and will impact different parts of the economy at different times, resulting in a series of “rolling recessions” as illustrated in Chart 1. Starting in 2022, the most interest rate sensitive parts of the economy, such as housing, manufacturing and industrials were the first to feel the impact of the FED’s lightening cycle, while consumer and travel related industries continued to perform well. The consumer and tech sectors experienced pockets of inventory gluts, as consumption patterns shifted from goods to services at the same time supply chains recovered.

Chart 1

In 2023, banks and commercial real estate struggled with high rates and high vacancy rates. Despite all this turbulence, the labor market has remained strong, resulting in resilient and robust consumer spending. Rounding out our look back at 2023, it was a volatile year for the bond market. Rates increased in the first half of the year and quickly fell in the last two months with the yield on the 10-year Treasury ending where it started at 3.8%. Bonds still generated returns between 4-5%, well above the 10-year average return of 1.8%. These two factors reminded us again of the wisdom of maintaining a position in bonds, while keeping maturity relatively short and quality high.

Investment Opportunities in 2024

As the new year unfolds, we will continue to focus on high-quality stocks that offer diversification and earnings growth at reasonable values, along with a mix of bonds and cash, and, for appropriate accounts, alternative assets and companies less proven than our core names.

Despite solid returns for the broad benchmark, and meteoric returns in a narrow slice of tech stocks, we are still finding high-quality stocks trading at reasonable valuations. In healthcare, there are medical device and diagnostics stocks that spiked up and down due to COVID, but should see solid earnings growth as hospital staffing and procedures normalize and have less pricing pressure from payers. We are also focusing on industrial and material companies that are selling non-core operations to improve their balance sheets and concentrate on their core businesses. These stocks should see modest top line growth of 3-4%, with increased focus on profitability expected to drive greater efficiencies and lead to both higher earnings growth and higher valuation multiples.

Acting as a ballast, bond investments remain a key element of our strategy. We have lengthened the duration of our clients’ bonds a bit to lock in higher yields to provide a stream of reliable income/distribution and to preserve capital.

Believing that the US can avoid a recession, we continue to keep equity weights near their long-term target and focus on protecting client capital by staying invested, capitalizing on higher interest rates, maintaining diversification with the equity portfolio and selectively adding to areas such as small cap and international where appropriate.

AI’s Role in Tech Giants Performance

With artificial intelligence much in the news, we have fielded many questions about AI and the extent to which AI contributed to the strong performance of the "Mag7" tech stocks in 2023. While difficult to quantify, it is clear that AI played a significant role in their ascent, though the extent varied across different companies. AI is heralded as the next big technological revolution, capable of disrupting industries and creating entirely new ones.

While still early in terms of use cases, AI is expected to significantly contribute to economic growth through automation, new industries and enhanced productivity, whether it is automating tasks, personalizing interactions, or using AI to scan medical images. Ultimately, AI is a key driver of innovation across industries and large tech companies have been the first to invest in AI research. This continuous innovation should lead to new products and services, contributing to their long-term growth and creating opportunities.